Capital with Purpose

Would you like to make a material impact in solving the Climate or Australian SME funding crises but don’t know where to start, how to proceed, think it too big a task, or don’t have the time and energy? Perhaps the cost is overwhelming. There is a way to do all of this.

Purpose Driven Capital, managed by Queensland’s oldest registered Venture Capital Management Partnership, has now launched the Sustainable Enterprise Fund as our way of doing something big to address these crises, using the federal investment program to incentivise up to $200 million of investment.

But even if your venture or small to medium enterprise is not suitable for investment by one of our funds we still want to assist, and that is why we are part of AuSMEquity. AuSMEquity provides free listings to all genuine Australian SME funding stakeholders; SMEs, investors, and advisers.

Pulling Together for the Australian Economy

The Australian Federal Government’s tax incentivised investment schemes, or the VC program, have some noble program objectives intended to support and grow the economy for the future:

- increase levels of venture capital investment in Australia,

- enhance the development of skills and experience of venture capital fund managers; and

- encourage early-stage investments in start-ups and expanding enterprises with a view to commercialisation of the activity.

We share these objectives and our Sustainable Enterprise Fund has the capacity to meet these objectives in a significant way while assisting more investors and investees by working collaboratively.

For a full discussion see Meeting the Objectives.

Lifetimes Defining Issue

Antonio Guterres, UN Secretary-General, said at the COP26 Climate Change conference “The state of the planet is broken. Humanity is waging war on nature. This is suicidal. Nature always strikes back, and it is already doing so with growing force and fury. Human activities are at the root of our descent towards chaos. But that means that human action can help solve it. Making peace with nature is the defining issue of the 21st century.”

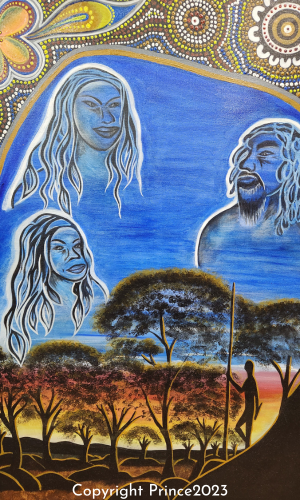

Social Agenda

We have incorporated our social agenda into our business model to address both issues of global man-made climate change and the Australian SME funding crisis. Not only will our Sustainable Enterprise Fund leverage up to $200 million into these areas, but we have dedicated 15% of the carried interest fees from the fund to charities.

Get Interested & Get Involved

This is what we are going to proudly tell our grandkids we did to help resolve the defining issue of our lifetimes, and theirs.

We know there are lots of others doing more than we are, and we salute them and their efforts.

We also know there are a lot of others that would like to get involved, and what better way than to leverage your expertise, experience and skills in business than to use business as the way to address our imbalance with nature.

Now, you can become a venture capitalist in Australia’s most innovative new fund, with the biggest hearts, by taking an interest and a slice of your own venture capital fund and becoming an Advisory Panel member.

Supporting Australian ventures is as old as our society and should not be left only to the biggest corporate and institutional investors, that is why we have made it available to you. Get Interested & Get Involved